How to Sabbatical II: Practical Considerations

By Guli Fager, MPH, CFP®, Financial Advisor

One: Can I Even Afford It?

I’ll go into a lot more detail about this later, but I use eMoney[1] for my own financial planning. In Toler Financial Group’s financial planning process, when clients come to us with questions about how to absorb a new, big expense (like a baby starting daycare, for example), we always ask clients to review their most recent 90 days of spending and make any relevant updates to living expenses. Since I bought a house this year, I knew I needed to confirm whether my spending estimates in eMoney were accurately reflecting some of the new costs I’ve taken on. Once I did that, I put in the cost of the trip to see if I could possibly afford it.

I anticipate spending about $30,000 on the trip, including a new bike, travel to San Diego and from St. Augustine, meals, insurance, clothing and gear I’ll need, as well as a few weeks of unpaid time off after I use up all my PTO[2]. I split the cost into $15k in 2025 and again in 2026 (though I’m not sure it’ll be hit exactly that way) and, with my income and anticipated bonuses, the 5 year cash flow projection suggested this plan was going to work for me.

What this projection told me was that while I could afford it without going into the red, essentially every “overflow” dollar I have this year and next will be spent on this trip. My regular income (not including bonuses) is pretty much all accounted for between regular expenses and retirement plan contributions, so this means that I have to carefully weigh expenses that are NOT related to this trip. If I needed the extra cash flow for the next few months, I would have been comfortable reducing my retirement plan contributions temporarily to just get the full match TFG offers, but it doesn’t look like I’ll need to make that tradeoff[3].

As I was making these calculations, I had about $500 of fall shopping in my Anthropologie[4] cart and realized: this is one day of the bike trip. I can buy new jeans when I get back (I might need to!). Not everyone would want to spend every extra dollar they’ll have on one big experience, so projecting the costs against income - and other needs that might come up in the meantime - is important.

Two: Will My Boss Let Me Go?

Many jobs just flatly do not have the flexibility to let employees take significant time off, even if they could afford to go without income for a time and/or spend a bunch of money on a big trip. I have a great boss (many of you reading this already know that!) who is a believer in the importance of time off and doing hard things. I felt confident that she would support the idea of this trip, but I knew I needed to check whether there were any drop dead events during the timeframe I was proposing to be gone before I paid a deposit. March and April are good months to leave because nobody else had vacations planned, and this way I’ve got good coverage while I’m away and I’ll be able to hold down the fort when colleagues want to go away themselves in the summer because I’ll be all out of vacation time :) Tax day will fall during this time, but I can proactively send clients tax forms before I leave. She said yes :)

Three: Will I Actually Enjoy it?

Even though I have done several 100+ mile rides, those events are over in one day. Would I actually like biking for almost 60 days in a row, and how would my body adapt? In triathlon training you don’t usually bike two days in a row. So I went on a 5 day gravel biking trip this summer with Trek Travel[5], where the mileage was lower than what I’m used to but the elevation gain really intense. Physically the trip was challenging but really fun to be with a group of people who were doing the same thing. Once I tested the hypothesis that I would enjoy biking day after day, I knew I needed a training plan.

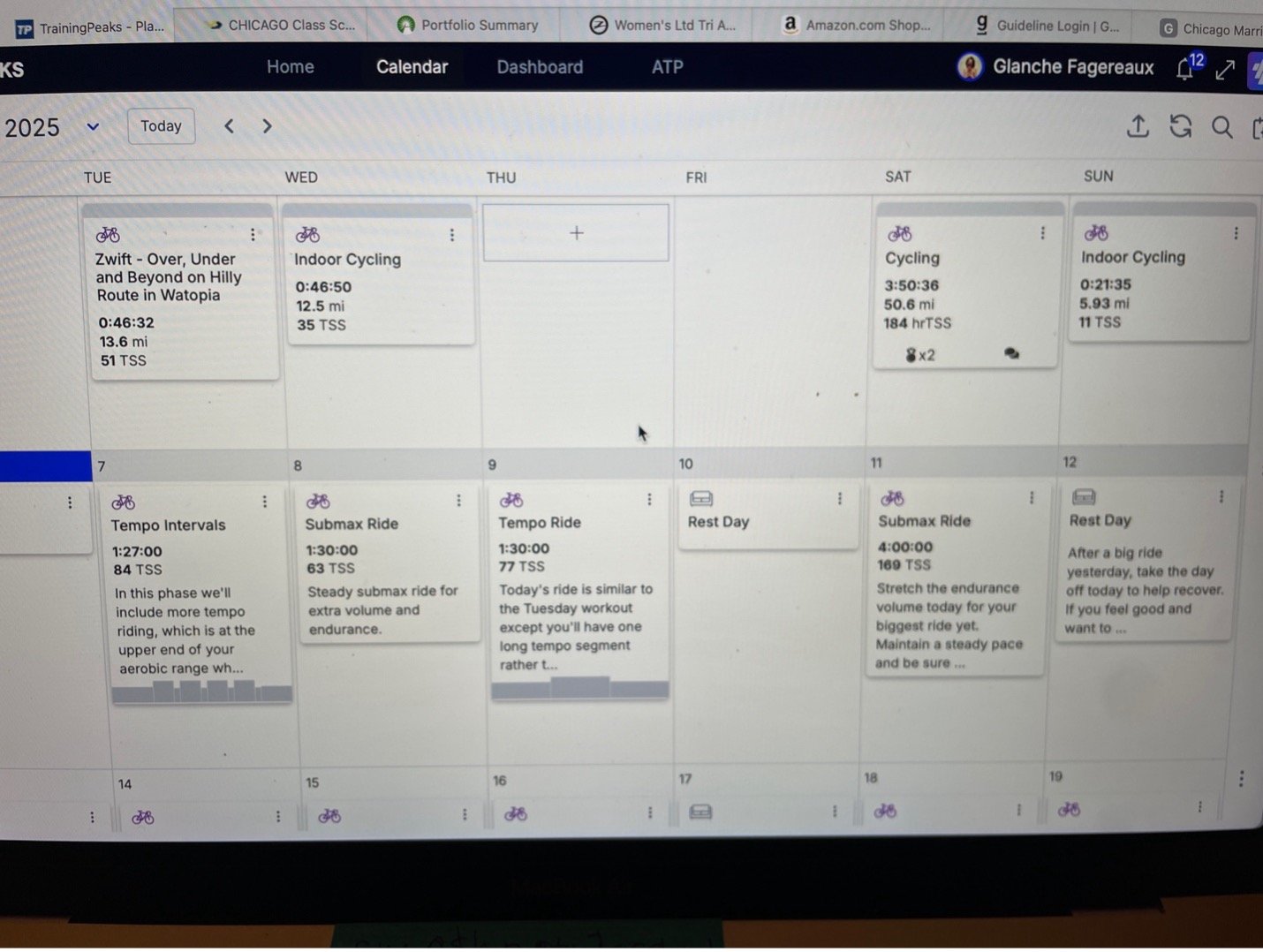

I started using my trainer more, riding two days in a row, and doing long rides on the weekends, but I was just sort of winging it. I trained for and completed an Ironman in 2024, so I know that I have the capacity to comply with a months-long training regimen, but I also know I need a coach and a training plan — the brainpower required to come up with the exercise plan to accomplish something like this is beyond me. If I don’t know at the beginning of a workout what the goal is, how long it’s supposed to be, and how hard to make it, I get bored after about 45 minutes (see below). The triathlon coach I’ve worked with for all of my races - Ryan Falkenrath of Set the Pace Triathlon[6] — was amazing, but training for a 60 day 3300-mile trip is a different animal than a single 140.6 -mile day, so I found a different coach, Tom Murray of Vision Quest Coaching[7] in Chicago (more on Tom later).

You can see the difference between what I was doing on my own compared to what I did once I got the training plan; once the workouts my coach put together for me showed up in Training Peaks and Zwift (the simulator program for my smart trainer), I had no problem riding for 90 minutes inside; but on my own, I tapped out after less than an hour.

Now that I’m a few weeks into the new training plan, I’m ready for the next big thing — buying a new bike. Next week, thoughts on budgeting for gear.[8]

[1] References are for illustration only; no affiliation or endorsement is implied.

[2] Decisions affecting pay, taxes or benefits should be reviewed with your tax pro & HR.

[3] Changes to retirement plan contributions can have a potential impact on long-term savings & taxes.

[4] References are for illustration only; no affiliation or endorsement is implied.

[5] References are for illustration only; no affiliation or endorsement is implied.

[6] Ibid.

[7] Ibid.

[8] This is a personal narrative for educational purposes only and isn’t individualized advice. Your situation may differ.